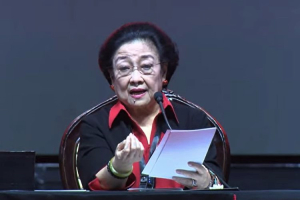

AI in mining could unlock US$308 B potential for Indonesia, says Deputy Minister

The use of artificial intelligence or AI technology in the mining industry is estimated to add an economic potential of US$308 billion (Rp5,200 trillion, said Deputy Minister of Communication and Digital Application Nezar Patria.