PHM continues 2nd “sail away” phase of SNB AOI project in Mahakam

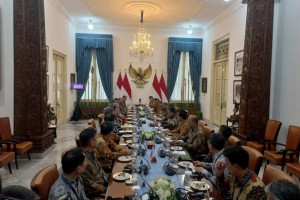

PT Pertamina Hulu Mahakam (PHM), a subsidiary of PT Pertamina Hulu Indonesia (PHI) Kalimantan Region, held a sail away ceremony for the second phase of the Sisi Nubi Area of Interest (SNB AOI) Project for topside platforms WPN7 and WPN8 at PT Meindo Elang Indah facility, Tanjung Pinang, Riau Islands on Tuesday, May 6, 2025.