Sun Energy launches ESG education initiative to support green energy transition

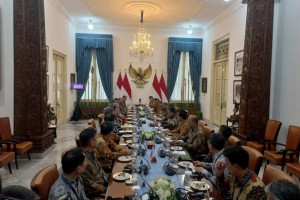

Sun Energy, a solar energy developer, launched its social pillar-focused ESG initiative on Wednesday, April 30, 2025, with a nationwide educational program titled SUN RISE (SUN Renewable Insight & Solar Expertise).