China and Indonesia have been in a stand-off over the waters around Indonesia’s Natuna Islands, which is part of the South China Sea, for quite some time now. In the most recent incident, Chinese diplomats requested Indonesia to stop drilling at an oil and gas block in the area.

According to a report from the Indonesia Ocean Justice Initiative, a letter was sent from Chinese diplomats to Indonesian Foreign Ministry, claiming it was a Chinese territory and obliged Indonesia to halt drilling activity at a temporary offshore rig.

The infamous nine-dash line claim

In 1947, China published a U-shaped eleven dash line of the South China Sea. After a negotiation with Vietnam, two dashes were removed from the map, reducing the total to nine. The nine-dash line claim is based on historical facts during the Ming Dynasty era, in which China’s influence spread into various parts of the nine-dash line demarcation, including parts of Southeast Asia.

According to Beijing’s claims, the water around the drilling activity, which includes the Exclusive Economic Zone of Indonesia in the Natuna waters, is part of the nine-dash line concept.

Beijing sees the area inside the nine-dash line as its territory. The contested area of the South China Sea includes Paracel Island, the Spratly Islands, Pratas Island, Vereker Banks, the Macclesfield Bank and Scarborough Shoal.

According to Nikolaus Loy, an expert in international relations at UPN Veteran University in Yogyakarta, the Chinese claim regarding the nine-dash line does not have any legal basis.

“In International Law, it was not recognized,” he stated.

Based on United Nations Convention on the Law Of the Sea (UNCLOS), to define a country’s territory, it should draw a line from its outermost island to 12 nautical miles as the territory of that country and 200 nautical miles as its exclusive economic zone.

According to Abdul Kadir Jailani, Foreign Ministry’s Director-General for Asia, Pacific and Africa affairs, Indonesia and China have never sat at the negotiating table concerning the South China Sea dispute. On July 2016, an International Tribunal for the Law of the Sea (ITLOS) rules that China violates international laws with regard to its nine-dash line claim and that the claim has no legal effect.

Twelve oil and gas exploration and production blocks

A large part of the claim is based on the Natuna waters’ natural resources and opportunities that it can create.

According to Loy, China has become an energy-hungry nation due to massive and rapid industrial development. To protect its energy supply and to establish naval bases, China has acquired and rented ports in Africa, including Djibouti, and South Asia.

Loy said China’s insistence on claiming the South China Sea may be motivated by the region’s richness in oil and gas. Moreover, according to him, the country needs fishery products to feed its 1.4 billion citizens.

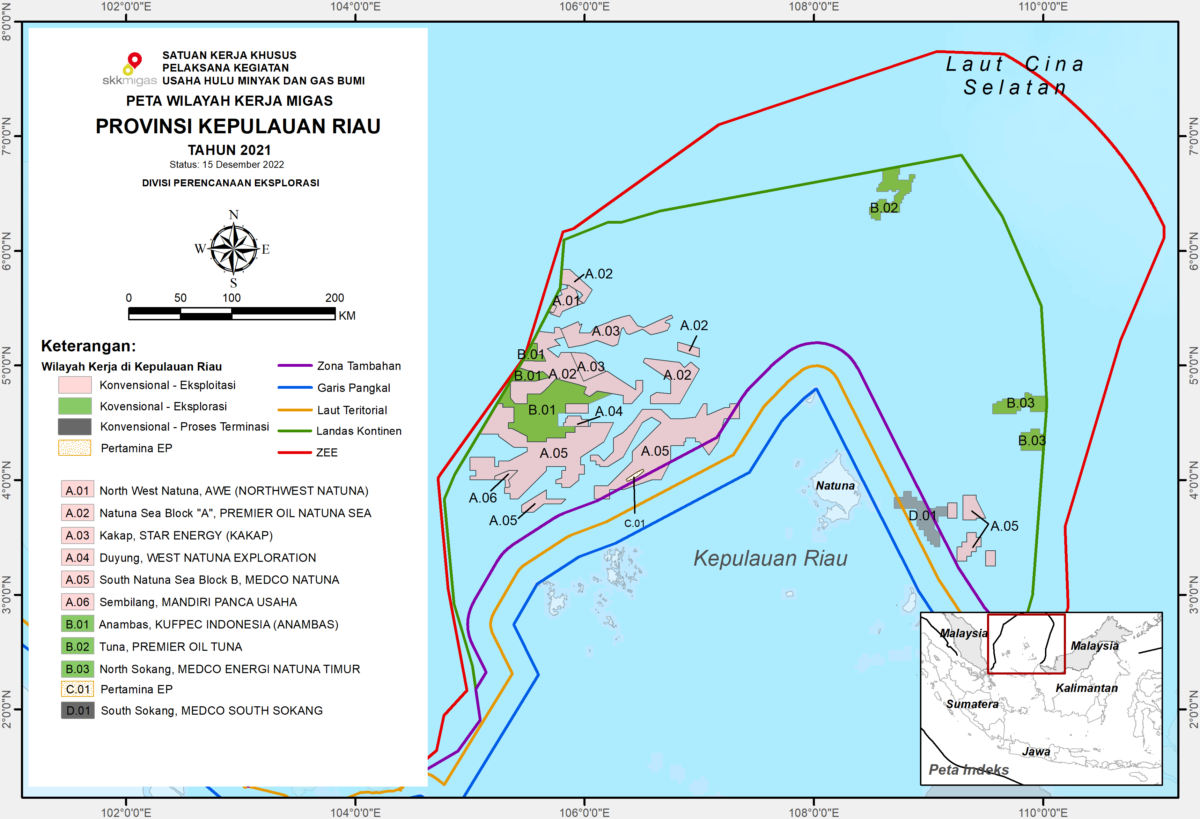

Darwin, a senior official at the Riau Islands Province’s Development Planning Board, said Natuna Islands and its waters has enormous potential of oil and gas and fishery products. There are 12 oil and gas exploration and production blocks in the area. As of now, seven of these blocks are already being exploited, including Anambas owned by Kupfec, Duyung owned by Conrad Energy and Kakap owned by Star Energy.

While four other blocks are operated by Premier Oil, Medco and Kufpec are still in the exploration phase, including the Tuna block which is owned by Premier Oil, while the South and North Sokang blocks by Medco. According to data provided by Indonesia’s oil and gas regulatory body SKKMigas, in 2021, oil and gas companies in the Natuna area produce 16,560 barrels of oil per day and 399 MMSCFD (Million Standard Cubic Feet per Day) of gas.

The oil and gas blocks mentioned above are not the only potential oil and gas blocks explored and surveyed by companies and the government. Darwin said many more blocks have not yet been explored so the reserves capacity is unknown.

Downstream oil and gas and fishery products

Darwin said the Natuna regental administration had provided hundreds of hectares of land as the onshore receiving facility for the projects. Upon completion of the gas industrial estate, gas will be transported from the gas fields to markets such as Singapore, Bintan, Java, Kalimantan and Sumatra. From the landing point to the market, hundreds of kilometers of gas pipelines will be constructed to transport the gas for power plants and petrochemical industry. He said a master plan for the gas pipeline is under the auspice of the Ministry of Energy and Mineral Resources.

The waters also contain rich fishery products. In 2020, the Natuna regency recorded 1,200 tons of captured fish, mainly groupers, mackerel tuna, Spanish mackerel, yellow tail fish and anchovies. There is considerable potential for fishery products in the area. The wide catchment area makes Natuna a viable candidate for investment in fishery processing industries. For the time being, anglers in Natuna only caught, stored and sold fish as there was no fish processing plant in Natuna, Darwin explained.

Indonesian Navy and coast guard protect the area

Loy believed the Indonesia western fleet base should be moved to Natuna from its current location in Jakarta. He added that Indonesia must deploy more naval fleets in the North Natuna Sea or the South China Sea due to China’s aggressive approach in that area. It is expected that the oil and gas resources in the site will be protected.

At the same time, it is also necessary for Indonesia to strengthen the ability of local anglers to catch fish in these waters. For this to happen, they will need bigger ships and better navigation systems. In addition, the significant presence of Indonesian vessels will further strengthen their claim over the waters. The purpose of this is to serve as the eyes and ears of the Indonesian Navy and coast guard to protect the area.