Jewelry store company PT Hartadinata Abadi Tbk (HRTA) will open 15 new stores in 2023 through its Capital expenditure of about IDR 50 billion.

Established for more than 20 years in jewelry business, HRTA manufactures and trades jewelry and gold. The company has a distribution network to market its products with wholesalers, gold shops, franchises, and its own retail stores. The company has several brands such as Aurum Collection Centre (ACC), ACC Premium, Claudia Perfect Jewelry, and Celine Jewelry.

Currently, the company has 2 subsidiaries namely:

- PT Aurum Digital Internusa (HRTA has 90% ownership);

- PT Gemilang Hartadinata Abadi and subsidiaries (99%).

Expands retail stores

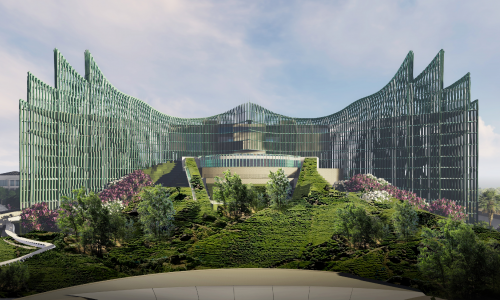

Hartadinata is focusing on establishing new stores for its jewelry and gold products which will be facilitated by its 2023 Capex. The company also uses the Capex for gold purification, expansion of retail store networks, and the development of its main headquarters.

These new stores will be opened in some regions in Indonesia, not only in the Greater Jakarta (Jabodetabek) but outside Java Island as well, said Director of Investor Relations Abadi Thendra Crisnanda.

“In 2023, we will aim for outside Java Island especially Sumatra. There are also plans for expansion in Sulawesi and Kalimantan,” Crisnanda told Kontan.co.id on January 10, 2023.

Since 2022, Hartadinata opened 10 new retail stores from the previous 68 stores.

“The expansion of our store network is important for our existence in corporate and product branding to make us recognized by the wider community,” Crisnanda said.

Until September 2022, the company recorded net sales of about IDR 5.1 trillion, or 30.67% higher than the net sales of the same period in 2021 at about IDR 3.9 trillion.

Its wholesale dominated the company’s total sales, reaching 90.87% or about IDR 4.63 trillion. Retail sales followed with IDR 400 billion, while franchise fee income reached IDR 11.33 billion, and loan interest and administration from pawn business was at IDR 55.28 billion.

Risk in jewelry sector

Economic pundits have forecast the year 2023 will see global recession. Investment in gold is predicted to be one of the most interesting commodities. Countries such as China bought gold about 32 tons in November 2022.

Meanwhile, jewelry retailers are looking to accelerate their recovery from post-COVID-19 pandemic by conducting due diligence on retail strategy and business models.

However, there are still top biggest risks in the jewelry business such as:

- Theft and burglary, which is one of the biggest risks to jewelry store owners. It includes break-ins to the inventory when it is closed. Theft became one of the concerns that require workers to pay attention to customers. Surveillance systems are required in the business to track people around the store, and detectors on doors are needed if customers tried to steal jewelry during business hours.

- Damage or destruction of the store inventory is one of the serious issues facing the sector. Property insurance helps coverage which applies to fires, natural disasters, and other severe problems causing property damage.

- Digital theft and security breaches. Digital theft has become a breaching issue in this digital and modern world. Hackers could find their way hacking through the system and steal customer data for financial gains. Cybercrimes are serious issues for business owners with a digital system for their store. Identity theft is also a common cybercrime that leads to significant financial losses for customers and business owners.