Italian energy behemoth Eni is embarking on a spin-off strategy for its potential oil and gas (O&G) projects, aiming to bolster these endeavors while sharpening its focus on low-carbon business ventures.

According to internal sources, Eni is eyeing O&G projects in Ivory Coast and Indonesia as prime candidates for the spin-off initiative.

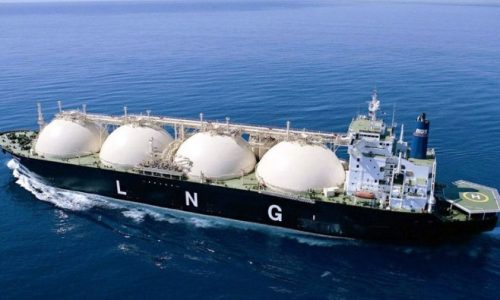

In Indonesia, Eni plans to establish a gas hub following significant reserve discoveries in Geng North-1 and the consolidation of other upstream assets acquired from Chevron and Neptune Energy.

Meanwhile, in Ivory Coast, Eni recently announced a significant offshore discovery in March and is actively producing oil and gas from the expansive Baleine field.

This strategic move reflects Eni CEO Claudio Descalzi’s vision to divide certain Eni operations into separate entities or satellites, facilitating the accumulation of fresh capital and attracting investors, including private equity firms and infrastructure funds.

The division also affords investors the flexibility to allocate funds between the traditional O&G sector and low-carbon businesses, catering to diverse investment preferences.

“The satellite model is a framework we’ve developed to secure additional funding sources to support traditional endeavors while simultaneously advancing greener initiatives,” remarked Francesco Gattei Eni’s Chief Financial Officer (CFO), as quoted from Reuters on Monday, May 13, 2024.

In recent years, Eni has established retail and renewable energy units, Plenitude, with shares sold to infrastructure funds, and a biofuel division, Enilive, which Descalzi hinted may consider selling minority stakes.

Eni intends to divest its ownership in both entities to secure additional financing for their expansion. This approach sets Eni apart from other oil and gas companies venturing into renewable energy.

“This strategy aims to showcase to investors the potential of nascent businesses striving to compete with the advantages of traditional oil and gas operations,” highlighted Gattei.

Furthermore, it signals a transition away from fossil fuel operations. Last month, Eni agreed to merge its North Sea oil and gas operations with Ithaca Energy in exchange for a 38.5% stake in the company, valued at nearly US$1 billion. This transaction allows Eni to reduce capital expenditure while potentially receiving dividends from Ithaca.

Gattei revealed that the group is exploring similar strategies for other exploration and production projects necessitating substantial investments, such as those in Indonesia and Ivory Coast.