Publicly listed nickel miner PT Central Omega Resources Tbk is focusing on domestic mining and the development of its second smelter factory in North Morowali, Central Sulawesi in July 2022. The company will also export its products to China, the biggest nickel importer in the world.

Established in 1995, Central Omega has been listed on the then Surabaya Stock Exchange (BEI) – now the Indonesia Stock Exchange – since 1997. The company started producing nickel ore in 2011 for three million tons per year and producing ferronickel in 2018.

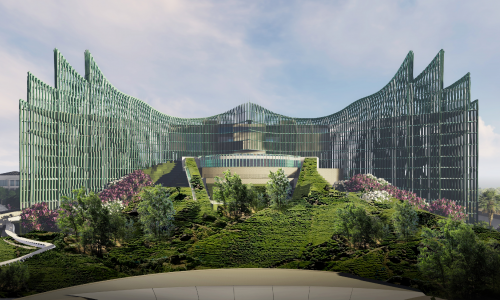

Central Omega has project developments, one of which is a phase II smelter located in North Morowali regency with an investment of IDR500 million and a capacity of 220,000 tons. The smelter is using an electric furnace technology. The company is currently in the process of selecting potential strategic partners due to market conditions and global pandemic constraints. It also hopes to have plans to determine strategic partners from outside. In its planning, the company discloses a capital expenditure (Capex) of IDR50 billion for 2022.

“The Capex plan is not too big, it is around IDR40-50 billion. It will be used for the acquisition of a grandson of a company that has changed mining to limestone. Currently, dozens of billions have been used,” Central Omega Commissioner Muhammad Rusjdi said during the public expose on July 22, 2022.

“There are potential strategic partners for the construction of this smelter. Of course, we need strategic partners from outside. Currently, we have several candidates being selected. However, we cannot disclose it before making a decision,” he added.

China is the company’s main export market. According to Rusjdi: “When we talk about smelters, now all of them are from China.”

Central Omega also has exported its ferronickel products to China, which is the largest user in the world. However, many domestic companies have begun to make use of ferronickel to produce stainless steel. In addition, the construction of phase II must rely on Chinese and foreign parties because it is not company’s expertise, which is a mining company from the start.

“The target for the 2024-2025 timeline is the phase II development while 2026 will be for development progress in commissioning and production,” said Rusjdi.

The investment is sought through assets that are already owned in the form of land as smelter II capital payment mechanism will be 30% shares and 70% loan.

During the public expose, the company currently focuses on mining in Indonesia and does not plan to expand abroad. The company realizes that Indonesia has the largest nickel reserves in the world, which is 52% of global nickel reserves, according to Kontan daily. This is one of the reasons why the company focuses on domestic market.

Following the government’s policy of zero net emission by 2060, Indonesia aims to increase the number of electric vehicles (EV) which will increase the need of nickel as one component of the battery electric vehicles (BEV). The Industry Ministry targets the number of BEV to reach 600,000 units by 2030.