Property developer PT Makmur Berkah Amanda Tbk is investing IDR90 billion in capital expenditure (Capex) to develop the Halal Industrial Park Sidoarjo (HIPS). PT Bank Central Asia (BCA) Tbk, the country’s biggest private bank, will provide the loans for the 2022 Capex.

Established in 1996, Makmur Berkah has become one of Indonesia’s top property developers. The company is centered in Sidoarjo, East Java, which portfolio includes residential development, an industrial complex and a warehouse. The company has 300 hectares (ha) plot of land.

Focusing on Halal Industrial Park

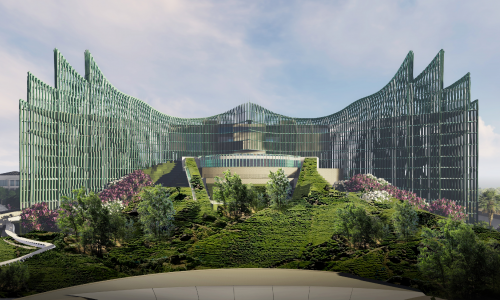

The company’s HIPS, which has operated since November 2021, is an industrial area based on a sustainable halal ecosystem with a halal, sustainable and integrated concept supported by guaranteed halal facilities and services. It provides halal management office, halal supervisor & auditor, halal lab and halal logistics.

“We have big customers such as [marketplace] JD.ID, [shoemaker] Ecco, Pakdé, Yahata Japan, Toyo Ink, PT HM Sampoerna Tbk, Temans and others. There are more than 400 tenants operating in our area,” said Ade Saputra Tedja Surya, President Director of Makmur Berkah.

He added the IDR90 billion Capex includes IDR50 billion for the first phase of Westin Hotels & Resort in Ubud, Bali, and another IDR40 billion is for the development of a loading dock to be rented later. The Capex for the development of the safe‘n’lock industrial area comes from internal cash, as well as the halal industrial area. Meanwhile, the hotel acquisition will be financed through company’s fund and loans from BCA.

Surya said the company still has problems such as public activity restrictions (PPKM) due to COVID-19 pandemic and business license. The company also has plans to expand the industrial area permit and safe’n’lock warehousing, land acquisition for industrial area expansion and safe’n’lock warehousing and construction of a 9,600 square meters loading dock building. It also plans for hotel acquisition and/land acquisition in the development of hotel business.

Challenges for Makmur Berkah in recent years

According to property advisory Knight Frank Indonesia, as quoted by Rumah.com on May 27, 2022, there are obstacles in property development in Indonesia such as a wave of inflation that affect property sector, an increase in Value Added Tax (VAT) and the Russian-Ukrainian war.

However, on the other hand, there is potential for good project development in the Greater Jakarta (Jabodetabek) area, which is a benchmark for potential national property. Knight Frank Indonesia Country Head, Willson Kalip, said Indonesia’s new capital city in East Kalimantan could be a potential city for property investment development while the Jabodetabek area would still not lose its prestige.

Makmur Berkah’s revenue in June 2022 reached around IDR45.65 billion, an increase from the previous year of 2021 of IDR32.81 billion. The company’s total revenue target in 2022 is estimated to reach IDR105.63 billion, consisting of IDR64.5 billion in building lots; IDR12.94 billion in Element by Westin Bali hotel and IDR28.23 billion in lots to rent.