According to a survey by The Centre For Strategic and International Studies (CSIS) and Tenggara Strategics, funding for the early retirement of coal-fired power plants (PLTU) is not gaining significant interest from foreign investors.

The Indonesian government had initially aimed to transition towards clean energy by planning the early retirement of PLTU, believed to yield positive benefits for the environment, society, and the economy.

This step is expected to lower carbon emissions to achieve the net zero emission (NZE) target by 2060. Normally, the operational life of PLTU is around 24 years, but this can be reduced to 15 years to reduce carbon emissions. The plants would then be replaced with more environmentally friendly alternatives.

The government’s plan involves using funds allocated for the early retirement to accelerate the decommissioning process. The plants would be re-operated with an expedited shutdown schedule, which is deemed not to disadvantage the plant owners.

However, this endeavor faces challenges. To expedite the plan, funding is required from various sources, including the Asian Development Bank (ADB), through the energy transition mechanism (ETM), using a concept known as blended financing, involving both public and private investors.

President Joko ‘Jokowi’ Widodo initially disclosed this plan during the Hannover Messe 2023 industrial exhibition in Germany, stating intentions to retire coal-fired PLTU by 2050.

Difficulty of financing early PLTU retirement

The early retirement of coal-fired PLTU falls under the Just Energy Transition Partnership (JETP) funding scheme. Indonesia has committed to a JETP funding of $20 billion or approximately IDR 310 trillion, a significant portion of which is allocated for the early PLTU retirement.

Riyadi Suparno, the Executive Director of Tenggara Strategics, noted that funding for early PLTU retirement is challenging since the funds can only be sourced from commercial banks due to the plan not yet falling under the green taxonomy.

“The challenge with coal-fired PLTU early retirement lies in financing,” stated Riyadi during a media briefing in Jakarta on Tuesday, August 22.

Based on documents collected by CSIS and Tenggara Strategics, early retirement of coal-fired PLTU falls under the “red” category in banking financing taxonomy.

Despite the aim of early retirement to accelerate achieving Net Zero Emission (NZE) by 2060 or earlier, foreign or global investors are generally hesitant to include fossil fuel-based assets in their portfolios, as this might negatively impact their image.

Furthermore, Riyadi noted that the Indonesian government has been trying to convince Southeast Asian countries to adjust their investment taxonomy to accommodate early PLTU retirement. This effort was made through the ASEAN Taxonomy for Sustainable Finance 2.0 published in March 2023, categorizing early PLTU retirement as “green” or “yellow” economic activities.

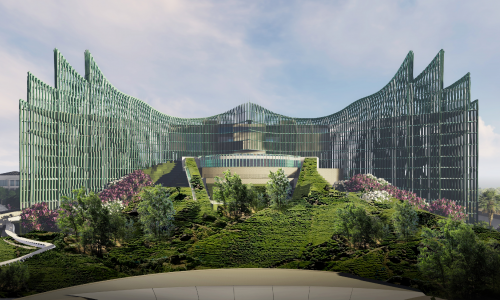

Jokowi’s administration maintains a commitment to advancing the green energy agenda and encouraging sustainable investment to propel Indonesia towards a greener and more environmentally friendly future.