PT Indonesian Paradise Property Tbk (INPP) is preparing a capital expenditure (Capex) of IDR 800 billion (US$ 53.44 million) for 2023 to build six new projects in Jakarta and other cities. The company also eyes a 20%-30% growth in revenue this year.

Established in 2002, INPP focuses on hospitality industry and invests in other entities. The company owns the Grand Hyatt and the Keraton at the Plaza Hotel, both in Jakarta; Sheraton Bali Kuta Resort, and Harris hotel chains in several cities.

Currently, it has several subsidiaries with high ownership as of 2023, such as:

- PT Adhitama Citra Selaras (100%)

- PT Anugerah Nusaraya (79.93%)

- PT Indonesia Gemilang Mahasentosa (75%)

- PT Kega Property Utama (92.73%)

- PT Paloma Suasa Manajemen and subsidiary (99.9%)

- PT Praba Kumala Sajati and subsidiary (100%)

- PT Retzan Indonusa and subsidiary (100%)

- PT Segara Biru Kencana (100%)

Investments in six projects

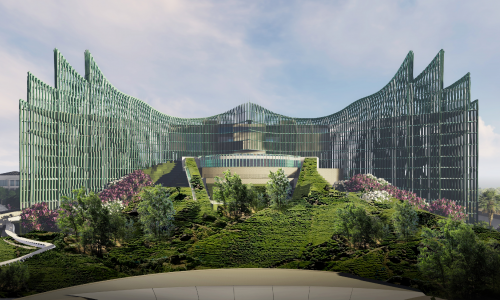

“We will continue six projects in 2023, including 23 Paskal Extensions in Bandung, Antasari Place, 2 mixed use development projects in Semarang and Makassar and the Hyatt Place in Makassar. We are also reviewing landed residential and commercial project in Balikpapan,” CEO Anthony Prabowo Susilo said as quoted by kontan.co.id on January 26, 2023.

Susilo explained that the INPP would provide a positive synergy for the ongoing projects thanks to the company’s competence as a reliable retail operator.

“Our strategy is to complement what has become the basis of our expertise, namely retail operations. How do we bring more value,” he said.

INPP Chief Finance Officer Surina explained that the Hyatt Place Makassar would be the first and only one in Indonesia at the moment. The company targeted the project to be operational in 2024. “We are currently speeding up the construction. Our target is that it will be completed by the end of 2023 so that it can operate in 2024,” he said.

Susilo expressed his optimism that the company would continuously develop and transform its business. “INPP always strives to achieve even higher achievements, namely through (property) mixed-use,” he added.

“We are targeting our revenue to grow by 20% to 30% in 2023. The estimate is more than IDR 1 trillion. We can’t mention the details yet, because we haven’t audited for the fourth quarter yet,” said Surina.

Risk in property industry

However, INPP faces several risks as the company is heavily dependent on the real estate market. Any fluctuations or downturns in the market could negatively impact its business and financial performance. Additionally, the company’s performance is also dependent on the success of its projects. Delays or complications in the development and construction could also impact its performance.

Another risk for INPP is the intense competition in the real estate industry. The company may face difficulty in attracting and retaining customers and tenants. INPP also faces the risk of regulatory changes or economic downturns that could negatively impact its business.

Furthermore, INPP is exposed to the risk of natural disasters and other unforeseen events that could disrupt the company’s operations and result in financial loss. The company may also be exposed to risks related to the performance of its tenants and partners. These parties’ failures might negatively impact INPP’s performance.