The global aviation industry has seen an increasing trend thanks to the presence of budget airlines and the increasing number of passengers in recent years. The industry, however, was hit hard by the COVID-19 pandemic when governments worldwide imposed lockdowns and limit people’s movements. In 2022, the number of passengers in Indonesia has seen a rebound and the forecast for 2023 remains positive. The growth is also supported by the development of 4 airports to anticipate the growing number of passengers.

In 2022 alone, an estimated 1.38 million passengers travelled during the Christmas and New Year holidays and the number of flights reached around 10,000. Bali, Lombok and Labuan Bajo were favorite destinations, according to Deputy Chairman of the Association of the Indonesian Tours and Travel Agencies (ASITA) Budijanto Ardiansyah on December 14, 2022.

Pandemic drives decreasing trend

The recent trend of the domestic flight route network has experienced a slight decline. In 2020, according to INACA (Indonesia National Air Carrier Association), there were 378 domestic flight routes or a reduction of 32 routes.

The impact of the pandemic was felt in 2021 when the number of passengers only reached 33.4 million, a 6% decrease from the previous year in 2020.

Domestic networks and routes

| Information | 2017 | 2018 | 2019 | 2020 | 2021 |

| Route according to permission | 374 | 406 | 444 | 410 | 378 |

| Permitted capacity | 145,632,240 | 147,409,808 | 141,295,427 | 148,601,851 | 145,524,821 |

| Passengers | 96,890,664 | 101,951,258 | 79,466,559 | 35,393,966 | 33,364,983 |

| Connected cities | 128 | 138 | 145 | 138 | 135 |

| Operational airlines (Pax) | 14 | 13 | 12 | 12 | 11 |

Meanwhile, the number of international passengers also dropped dramatically by 81% in 2020 to only 1.4 million passengers. In addition, international flight routes and the number of their networks have decreased by 8% or decreased to 145 routes in 2021.

International networks and routes

| Information | 2017 | 2018 | 2019 | 2020 | 2021 |

| Route according to permission | 129 | 153 | 170 | 157 | 145 |

| Permitted capacity | 57,823,064 | 56,374,344 | 57,407,948 | 45,037,060 | 51,321,478 |

| Passengers | 19 | 22 | 23 | 26 | 22 |

| Connected cities | 59 | 68 | 66 | 66 | 62 |

| Operational national airlines (Pax) | 9 | 10 | 9 | 8 | 7 |

| Operational foreign airlines (MPA) | 46 | 50 | 53 | 48 | 47 |

Domestic production and traffic

| No | Information | 2017 | 2018 | 2019 | 2020 | 2021 |

| 1 | Departure | 829,615 | 875,015 | 729,446 | 402,473 | 340,848 |

| 2 | Passengers | 96,890,664 | 101,951,258 | 79,466,559 | 35,393,966 | 33,364,983 |

| 3 | Freight & Mail | 587,018 | 651,160 | 577,805 | 430,753 | 419,514 |

| 4 | Revenue PAX Km | 78,998,404 | 86,200,159 | 70,223,670 | 31,666,995 | 34,827,461 |

| 5 | Available Seat Km | 101,861,323 | 109,812,051 | 93,977,386 | 54,106,971 | 53,314,780 |

| 6 | Seat Load factory (%) | 77.6 | 78.5 | 74.7 | 58.5 | 64.1 |

| 7 | Revenue Ton Km | 6,951,148 | 7,794,047 | 6,340,009 | 2,949,359 | 3,326,564 |

| 8 | Available Ton Km | 11,192,338 | 12,125,446 | 10,320,674 | 6,058,005 | 6,408,062 |

| 9 | Wight Load Factory(%) | 62.1 | 64.3 | 61.4 | 48.7 | 51.9 |

International production and traffic

| No | Information | 2017 | 2018 | 2019 | 2020 | 2021 |

| 1 | Departure | 85,072 | 94,909 | 84,154 | 20,877 | 7,156 |

| 2 | Passengers | 12,494,442 | 13,780,197 | 12,139,588 | 2,045,851 | 184,848 |

| 3 | Freight & Mail | 142,178 | 144,997 | 110,511 | 80,780 | 98,680 |

| 4 | Revenue PAX Km | 33,563,719 | 38,806,394 | 33,021,430 | 6,072,810 | 549,528 |

| 5 | Available Seat Km | 45,256,705 | 52,806,394 | 45,295,2001 | 11,423,806 | 4,830,641 |

| 6 | Seat Load factory(%) | 74.2 | 73.5 | 72.9 | 53.2 | 11.4 |

| 7 | Revenue Ton Km | 3,723,871 | 4,176,193 | 3,553,735 | 856,771 | 354,988 |

| 8 | Available Ton Km | 6,000,245 | 6,710,309 | 5,606,855 | 1,537,510 | 808,986 |

| 9 | Wight Load Factory(%) | 62.1 | 62.2 | 63.4 | 55.7 | 43.9 |

Estimated growth in 2023

INACA has forecast that the 2023 will see 6,975,222 passengers traveling on airlines. State-owned airport operator PT Angkasa Pura (AP) I is optimistic that the number of international passengers will increase by 52%, or 9.2 million passengers on 57,000 flights. AP I also estimates a 17% growth in 2023 or 59 million passengers on 581,000 flights.

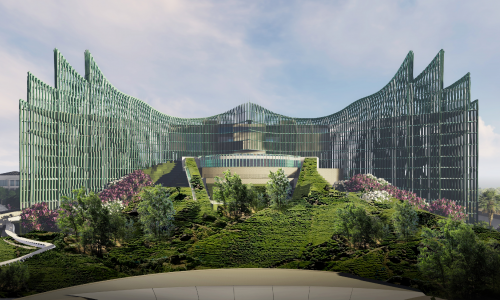

AP I is accelerating the completion of airport development projects to support connectivity in the country. The projects cover the Sultan Hasanuddin Airport in Makassar (South Sulawesi), Juanda Airport in Surabaya (East Java), Lombok Praya Airport (West Nusa Tenggara) and Sam Ratulangi Airport in Manado (North Sulawesi).

The development of the airports is a strategic effort in supporting the number of flights and the increasing number of passengers, as well as boosting air connectivity and air transport and logistics traffic capacity in the central and eastern parts of the country.

Airport anticipation for peak season

The reopening of Mecca for umrah has added the increasing number of pilgrims flying to Saudi Arabia’s Holy City to perform their observance.

Operations Director of PT Angkasa Pura (AP) II, Muhammad Wasid, said the operator has set up an Umrah Lounge at the Garuda City Center (GCC) at the Soekarno-Hatta International Airport, near the airport’s Railink Station, to support and accommodate the increasing passengers. The lounge has various facilities, such as a VIP room, common room, prayer room, cafe and canteen.

“The GCC Umrah Lounge was opened on December 18, 2022. Therefore, the rising number of passengers at the airport’s Terminal 3 could be handled properly,” he said.

The Ministry of Transportation has required AP II to optimize infrastructure at 20 airports in Indonesia.

“The infrastructure on both the aerial and ground sides will be ready. On the aerial side, for example, the runway overlay (thickening) was carried out at HAS Hanandjoeddin Airport (Belitung) and Tjilik Riwut Airport (Palangkaraya),” AP II Director of Engineering Agus Wialdi said on December 19, 2022.

Risks in airline industry

The COVID-19 pandemic in the past two years has shown how it greatly affected aviation industry. The massive vaccination has helped the economy recovery, thus assisted the industry to rebound as well. However, some challenges remain.

The rising and unstable fuel price has risen since 2020. Significantly, oil price hit a high point in March 2022. Fuel is considered one of the main costs in airline operation (estimates vary by about 30%) and the increase will affect profitability.

There are no competitors in the domestic aviation industry since 2010. According to Nailul Huda, an economist from the Institute for Development of Economies and Finance (INDEF), the domestic airline industry has seen a duopoly of state-owned Garuda Indonesia Group and the privately owned Lion Air Group. Both groups previously controlled 80% of domestic market but has significantly increased to 96% after Garuda acquired Sriwijaya Air. The duopoly has resulted in the airlines’ price control, leaving consumers with limited bargaining power.

The government has imposed an increase in floor price by 30% to 35% with an excuse of “protecting airline companies”.

However, Huda highlighted the irregularity in the domestic airline industry as companies have yet to lower their prices whereas other airlines in Southeast Asia already did.

“Only airlines in Indonesia are increasing the [ticket] prices amidst the declining prices on domestic flights in Southeast Asia,” he said on June 16, 2019.

The Load Factor Level, which has not yet reached the Breakeven Load Factor (BLF), in Indonesia has an average of 78%, which is far greater than airlines in Asia Pacific, which ranges from 67%-69%. Huda said with such a high BLF, domestic airlines would certainly make a profit, but they still found a reason for saying they were “losing money”.