China International Capital Corp (CICC), the largest investment bank in China, is planning to expand into Indonesia as part of its strategy to explore new markets in Southeast Asia.

This decision is driven by the slowdown in local transaction activities due to increasing geopolitical tensions and a weakening Chinese economy.

A report by KPMG accounting firm highlights a 75 percent year-on-year decline in fundraising from A-share initial public offerings (IPOs) in China during the first half of 2024, totaling RMB56.5 billion (Rp125.85 trillion).

The number of IPOs also fell by 70 percent to 52. Meanwhile, the Hong Kong IPO market saw a 35 percent decrease in funds raised, amounting to HK$11.6 billion (Rp24.07 trillion), with a 15 percent drop in IPOs to 27.

CICC, which generated 74 percent of its revenue domestically in 2023, has been affected by these declines. Established in 1995, the bank has offices in major financial centers, including Hong Kong, New York, London, and Singapore, and recently opened a representative office in Vietnam to bolster its Southeast Asian presence.

In contrast, Indonesia’s IPO market led Southeast Asia and Hong Kong in 2023, accounting for 51 percent of regional activity and raising US$3.55 billion (Rp55.87 trillion) from 79 companies.

However, the first half of 2024 saw a slowdown, with 25 companies raising Rp4.07 trillion. Deloitte attributes this to investors’ cautious stance as they await policy directions from the newly elected President Prabowo Subianto and Vice President Gibran Rakabuming Raka.

Southeast Asia remains attractive for CICC due to its economic growth, youthful and skilled population, and evolving infrastructure. The bank sees significant potential in private funding for digital startups, especially unicorns, in the region, supported by its major shareholders, Chinese tech giants Tencent and Alibaba, which actively invest in these sectors.

CICC’s interest in Indonesia includes opportunities in consumer sectors, technology, media, telecommunications, fintech, logistics, and electric vehicles. The bank aims to capitalize on growing Chinese investments in these areas, including notable investments in electric vehicle manufacturing and mineral processing facilities.

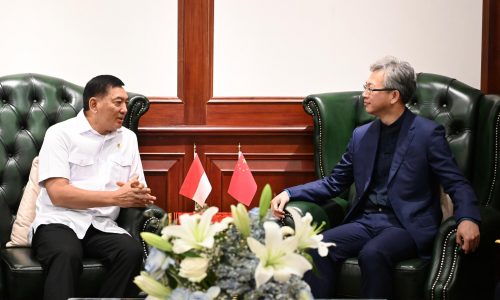

The Indonesian Financial Services Authority (OJK) has not yet received a formal application from CICC to establish a representative office in Indonesia. Dian Ediana Rae, OJK’s Chief Executive of Banking Supervision, noted that any foreign bank must comply with local regulations, including a minimum capital requirement of Rp10 trillion.

Ryan Kiryanto, an economist at the Indonesian Banking Development Institute (LPPI), emphasized Indonesia’s potential for banking sector growth, citing a loan-to-GDP ratio of around 35 percent and a funding-to-GDP ratio of about 40 percent. He highlighted Indonesia’s high net interest margin of 4 percent-5 percent, making it an attractive market for foreign banks.

The entry of foreign banks like CICC is expected to increase competition, benefiting consumers by providing more choices and encouraging local banks to innovate. Kiryanto believes that greater competition will improve the overall banking sector, supporting Indonesia’s economic development.

OJK is expected to provide guidance to ensure CICC’s operations contribute positively to Indonesia’s economy, aligning with the country’s broader economic goals and ensuring foreign banks support national development initiatives.