Chandra Daya's IPO oversubscribed 400 times, draws over Rp30T in investor funds

The initial public offering (IPO) of PT Chandra Daya Investasi (CDIA) has drawn overwhelming investor interest, with subscriptions oversubscribed more than 400 times, securing over Rp30 trillion (US$1.8 billion) in incoming funds − far exceeding the company's initial target of Rp2.37 trillion.

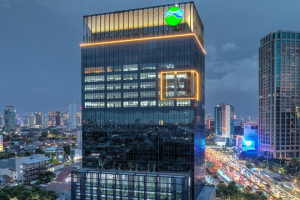

The IPO, which ran on July 2-7, 2025, will see CDIA listed on the Indonesia Stock Exchange (IDX) this Wednesday, July 9, 2025. CDIA is a subsidiary of PT Chandra Asri Pacific (TPIA) and is considered a lighthouse IPO, referring to listings with market capitalization above Rp3 trillion, typically carried out by large-scale companies that serve as benchmarks for others entering the market.

According to the final prospectus, CDIA released 12.48 billion shares, representing 10 percent of its total issued and paid-up capital, at Rp190 per share − the top end of its book-building range. With a nominal value of Rp100 per share, this offering is set to raise Rp2.37 trillion in fresh capital.

Six underwriters in support of the IPO:

● PT BCA Sekuritas;

● PT BNI Sekuritas;

● PT DBS Vickers Sekuritas Indonesia;

● PT Henan Putihrai Sekuritas;

● PT OCBC Sekuritas Indonesia;

● PT Trimegah Sekuritas Indonesia Tbk.

Premium valuation, strong fundamentals

Analyst and Head of Literation at Kiwoom Sekuritas, Octavianus Audi, noted that the IPO price reflects a premium valuation, with an estimated Price-to-Earnings Ratio (PER) of 40–45 times, significantly higher than the industry average of 15–25 times for the logistics infrastructure sector. He said this reflects CDIA's aggressive expansion strategy, including investments in ship fleets and terminal development funded by the IPO.

Despite the premium, Audi views CDIA as a promising long-term investment, supported by a strong net profit margin of 32 percent and a healthy debt-to-equity ratio (DER) of 0.44x in fiscal year 2024.

“If leverage remains low and the IPO fully funds expansion, CDIA will gain a long-term competitive edge,” said Audi, on Thursday, June 19, 2025. Based on the IPO price, CDIA’s estimated market capitalization would be in the range of Rp21.2 to Rp23.7 trillion.

Soaring financials

Angga Septianus, Community Lead at Indo Premier Sekuritas (IPOT), echoed the premium assessment, projecting CDIA’s PER at 42.9–47.9 times and Price-to-Book Value (PBV) at 2.0–2.3 times. He cited CDIA’s 35 percent revenue growth and 1,632 percent profit surge in the previous year as key indicators of its robust potential.

“PER above 10–15 times and PBV above 1 typically signal a premium stock. CDIA’s business outlook is extremely promising,” Angga said earlier on June 19, 2025.

Already have an account? Sign In

-

Start reading

Freemium

-

Monthly Subscription

20% OFF$29.75

$37.19/MonthCancel anytime

This offer is open to all new subscribers!

Subscribe now -

Yearly Subscription

33% OFF$228.13

$340.5/YearCancel anytime

This offer is open to all new subscribers!

Subscribe now