Silicon Valley Bank collapses, signs of another 2008 crisis

The Silicon Valley Bank (SVB), the former 16th largest bank in the United States, went bankrupt on March 10, 2023, marking one of the largest bank failures since the 2008 financial crisis. Within 48 hours, the bank collapsed after its stocks plummeted to 66%, as a result of The Federal Reserve's (The Fed) aggressive interest rates in Q1 2023.

The American Federal Deposit Insurance Corporation (FDIC) in California closed down SVB after the bank received a capital crisis and failed to receive additional capital within 48 hours, Reuters reported on March 12, 2023.

SVB - which was founded in 1983 in Santa Clara, California, by founder Roger Smith and co-founders Bob Medearis and Bill Biggerstaff - had a total asset of about US$ 209 billion and deposits total of about US$ 175.4 billion as of December 31, 2022. Its return-on-equity (ROE) was at 13.8% and its non-performing assets were at 0.05%.

The bank previously focused on venture capital business line and private equity on the technology industry sector and help to grow startup companies. SVB developed fast as a bank in the technology sector. Forbes magazine listed SVB as the 20th best bank in the US in March 2023.

Fed’s aggressive interest hikes cause repercussions

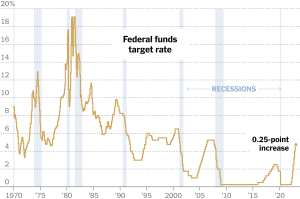

The Fed's increasing interest rates trend allegedly had caused SVB's bankruptcy. Global investors responded with dismay, resulting in the inevitable massive drawdown, Reuters reported.

The increase in the Fed's interest rate caused US banks' net interest to climb up by 16.5% to US$ 456 billion in Q1 2023, according to the FDIC. The Fed is raising interest rates aggressively to fight inflation.

"Depositors withdrew their money suddenly, and so quickly that banks went bankrupt, and the interday decline was inevitable due to massive withdrawals," CEO of Better Markets Dennis M. Kelleher wrote on cnn.com.

The increase in interest rates has hit many tech companies very hard, causing a reduction in the value of shares and making it difficult for them to raise funds. This is what drives investors to attract deposits in SVB to fund their operations.

Surprisingly, Twitter CEO Elon Musk is open to acquiring SVB and wants to turn the bank into a digital bank.

According to Goldman Sachs analysts, expected measures by regulators are needed to provide substantial liquidity to banks facing outflows to improve the confidence of depositors.

The US Government said they see little sign of a financial crisis like in 2008. This is because SVB's business supports the economy in a big way. The SVB problem is feared to have a systemic impact on the financial industry and startups.

However, Goldman Sachs said the Fed would not raise interest rates on March 22, 2023, due to considerable uncertainty for next month seeing the stress in the banking sector.

Central banks are now caught between rock and hard place; whether to prioritize inflation or ensure a well-functioning banking system. However, their balancing act means interest rates will stay even higher for even longer. The recent collapse in global yields and strengthening in emerging market currencies could be short-lived, as the risk-off sentiment may return when the markets realize the persistently hot inflation and job markets will be cooling at an even slower pace, economist Satria Sambijantoro from Bahana Securities explained.

SVB's internal problems

The bankruptcy of SVB was also due to several internal things, instead of external factors. Among them are:

- An old-fashioned method of managing funds: SVB holds deposits from clients and invests in safe assets such as bonds. An aggressive increase in interest rates, caused the start-up industry to withdraw funds massively, according to bisnis.com.

- The problem of diversification: The bank's business line is concentrated on one thing, which is the technology industry. When the sector deteriorates, so does SVB's condition.

- Market segment problem: SVB market segment only focuses on the startup industry. The bank is very loyal in providing funds to startups even though they don't have free cash flow, as well as startup founders who are not from the US.

Tag

Already have an account? Sign In

-

Start reading

Freemium

-

Monthly Subscription

30% OFF$26.03

$37.19/MonthCancel anytime

This offer is open to all new subscribers!

Subscribe now -

Yearly Subscription

33% OFF$228.13

$340.5/YearCancel anytime

This offer is open to all new subscribers!

Subscribe now