SVB’s collapse: lessons learned for Indonesia’s banking industry

The collapse of Silicon Valley Bank, SVB, sent shockwaves through the financial system, reviving memories of the global crisis in 2008.

SVB, whose clientele mainly consisted of American high-tech companies, was unable to cope with the flow of requests for reimbursement of deposits that its clients had entrusted to it, forcing the American authorities to contain the fire.

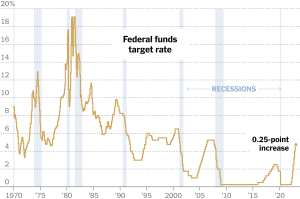

Within 48 hours, the bank collapsed after its stocks plummeted to 66 percent, as a result of The Federal Reserve’s (The Fed) aggressive interest rates in Q1 2023.

Does it have an impact on the Indonesian economy?

The collapse of SVB has caught the attention of many parties. However, many experts believe this case will not have a significant impact on the Indonesian economy and financial sectors

Compared to the 2008 financial crisis, the collapse of SVB would not have a significant impact on the Indonesian economy as its current position is much stronger than 15 years ago, with foreign ownership of government securities (SBN) dominated by domestic investors until the end of 2022.

This information was conveyed by the Chief Economist of Bank Mandiri, Andry Asmoro, as quoted from Bisnis.com, Wednesday (15/3).

Based on data, foreign ownership of SBN is only 14.5 percent of total debt securities. According to Andry, this means that the Indonesian economy will not be greatly affected when compared to the 2008 condition where foreign ownership of SBN was around 35 percent.

This is also in line with the statement of the Finance Minister, Sri Mulyani Indrawati, on Tuesday (29/3), who expressed optimism that the collapse of SVB would not shake the Indonesian economy.

However, Sri emphasized that the government, particularly the Financial System Stability Committee (KSSK), would remain vigilant in monitoring the impact of SVB on the Indonesian economy.

Similarly to the financial and banking sectors, Indonesia was also hardly affected, as the relationship between SVB and startups and banks in Indonesia was relatively small.

Unlike SVB and banks in the other US banks, banks in Indonesia do not provide credit or investment to technology-based startups and crypto companies.

Moreover, Indonesia also has no business relationships, facility lines, or investments in SVB securitization products, according to D-insights report, Tuesday (14/3).

On the other hand, data from the OJK shows the collapse of SVB has had a positive impact on the strengthening of the Indonesian rupiah by 0.47 percent as of March 13, 2023, and on national DSP directly by 0.003 percent.

Lessons learned for Indonesia’s banking industry

Although it does not have a significant impact on the Indonesian economy and finance, there are several valuable lessons from the collapse of SVB, along with other global banks.

One of the lessons is, even small-scale banks can have significant systemic risks to the entire banking system.

The collapse of global banks, especially SVB, also indicates its business model was not stable and had significant vulnerabilities.

Not only that, these global banks had also primarily invested in US bonds that were classified as available for sale (AFS), which were subject to fluctuations in valuation.

As the Fed increased its benchmark interest rate and the yield of US bonds increased, the valuation of the bonds held by these banks experienced a downward correction.

Regarding this issue, the President Director of BRI, Sunarso, has also pointed out the combination of multiple risk areas which contributes to the downfall, such as:

- The importance of managing reputation risk. Managing risks becomes important due to the issue of the company’s shares being sold by SVB executives and unrealized losses that raise concerns about reputation risk.

- Liquidity risk. Inadequate short-term liquidity, the failure of the contingency funding plan, and the importance for banks to manage the maturity of assets and liabilities to avoid mismatches.

- Market risk. The increase of FFR from 0.25 percent to 4.75 percent has resulted in an unrealized loss of AFS rising up to 15.54 percent against capital.

- Concentration risk. Fifty-five percent of SVB securities are mortgage-back securities, 79 percent of SVB securities have a maturity of over ten years, and 95 percent of deposits are non-maturity deposits (checking/saving accounts).

- Role of regulation. The unavailability of short-term funding facilities (FPJP) and relaxation of LCR and NSFR obligations.

In conclusion, the lessons learned from the collapse of SVB and other US banks are related to the concentration of depositors, losses from securities, and the imbalance of asset-liability, which should be managed properly.

Tag

Already have an account? Sign In

-

Start reading

Freemium

-

Monthly Subscription

30% OFF$26.03

$37.19/MonthCancel anytime

This offer is open to all new subscribers!

Subscribe now -

Yearly Subscription

33% OFF$228.13

$340.5/YearCancel anytime

This offer is open to all new subscribers!

Subscribe now